If we don’t contextualize it, it is difficult to interpret it, but it will help us understand the next concept. Short interest: this value will indicate the number of all the company’s shares that are short selling.

Volkswagen short squeeze how to#

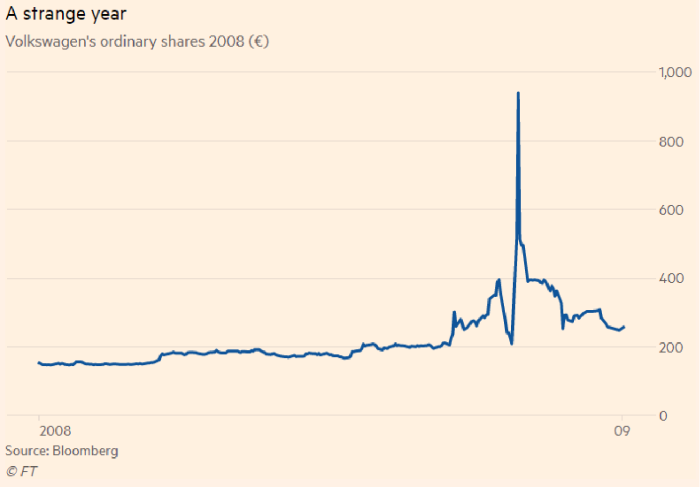

In order to detect them we must know how to calculate and the meaning of few additional fundamental concepts: The short-squeeze is a buying run on the asset at any price in order to close the short position. Those who are speculating that a “Short-Squeeze” will occur.Those who want to close their short-selling position.Those who wish to have the asset in their portfolio, that is, the usual market demand.This can create a bottleneck of people buying back the asset, leading to the market having three different types of demands on the stock: But what would happen if we are not the only short sellers who want to close their position on the asset? This will make our vision of the asset change, so we might be inclined to repurchase the stock to limit our potential losses. But let’s imagine that before we decide to do so, an unexpected event occurs in the market, be it a good quarterly balance sheet presentation or some news that has a positive impact on the asset. Our risk management: in order to be able to maintain the position until the end of our strategy without the broker making a margin call.Īs we mentioned in the first section, once we want to close our position we must repurchase the asset.In such a scenario, will not make any profit whatsoever. Our market timing: suppose we decide to close a trade at a loss and the asset then drops in price as we initially speculated.When choosing our short-selling strategy, it is vital to highlight two important factors: Therefore, our profit amounts to $39.5 (minus broker commissions). That is to say that at the time of closing our position the price is, for example, $60.8. The asset in which the short-selling began has fallen in price.Once the short position is initiated there are two possible scenarios: Let’s imagine that we decide to short a stock that is currently trading at $100.43. To start short selling, the counterparty will charge us interest while the position is open and will require us to leave certain guarantees, which can be liquid balance or other assets. Additionally, short-selling can also be used as a hedging method for our portfolio by shorting a share that we hold by a certain percentage. It can be used as a method of speculation for assets that we believe will drop in price. When selling an asset that we borrowed, an open position will be generated that at some point we must close. Short-Selling is an operation in which a loan of shares is requested from a third party (generally a broker) in order to be able to sell them, and later repurchase them at future date at a lower price than the one at which the operation began. In order to understand what happened during Volkswagen’s Short-Squeeze, we first have to understand two important concepts: short-selling and short-squeezes.

Required Concepts for understanding Volkswagen’s Short-Squeeze

0 kommentar(er)

0 kommentar(er)